Not known Details About Pkf Advisory Llc

Not known Details About Pkf Advisory Llc

Blog Article

The 9-Minute Rule for Pkf Advisory Llc

Table of Contents8 Simple Techniques For Pkf Advisory LlcHow Pkf Advisory Llc can Save You Time, Stress, and Money.Not known Facts About Pkf Advisory LlcExcitement About Pkf Advisory LlcThe 2-Minute Rule for Pkf Advisory Llc

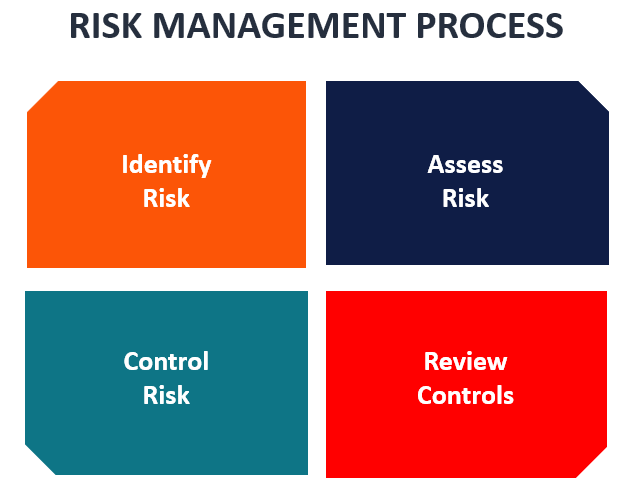

Centri Consulting Risk is an unavoidable component of operating, but it can be taken care of through thorough analysis and management. The bulk of interior and exterior risks firms face can be addressed and minimized through danger advisory finest techniques. It can be difficult to determine your threat direct exposure and use that info to place on your own for success.This blog is created to aid you make the ideal choice by addressing the concern "why is threat consultatory vital for services?" We'll additionally review inner controls and discover their interconnected relationship with company risk monitoring. Simply put, company dangers are avoidable inner (strategic) or external risks that affect whether you accomplish your business goals.

Every service should have a strong danger administration strategy that information present threat levels and exactly how to mitigate worst-case situations. One of the most vital risk advising finest techniques is striking a balance in between protecting your organization while also facilitating constant development. This calls for implementing worldwide methods and administration, like Committee of Sponsoring Organizations of the Treadway Payment (COSO) inner controls and enterprise danger monitoring.

An Unbiased View of Pkf Advisory Llc

Among the finest means to manage threat in company is with measurable analysis, which utilizes simulations or statistics to appoint risks particular mathematical values. These presumed worths are fed into a danger version, which generates a series of results. The results are evaluated by threat managers, that make use of the data to determine service opportunities and reduce adverse end results.

These reports additionally include an examination of the effect of unfavorable results and reduction YOURURL.com strategies if negative occasions do happen - market value analysis. Qualitative threat tools include cause and effect diagrams, SWOT evaluations, and choice matrices.

With the 3LOD design, your board of directors is responsible for risk oversight, while senior monitoring develops a business-wide threat society. Accountable for having and reducing dangers, operational supervisors look after everyday organization negotiations.

A Biased View of Pkf Advisory Llc

These tasks are commonly handled by monetary controllership, quality control groups, and compliance, that might likewise have duties within the very first line of defense. Inner auditors offer impartial guarantee to the initial two lines of protection to make certain that dangers are handled properly while still fulfilling functional goals. Third-line personnel ought to have a direct relationship with the board of directors, while still keeping a connection with administration in monetary and/or legal abilities.

A detailed collection of interior controls must include things like reconciliation, paperwork, safety and security, authorization, and separation of responsibilities. As the number of ethics-focused financiers remains to increase, several businesses are adding environmental, social, and administration (ESG) standards to their internal controls. Financiers use these to establish whether a business's values line up with their very own.

Social requirements examine exactly how a business manages its connections with staff members, customers, and the larger neighborhood. Administration requirements analyze a business's management, internal controls, audits, shareholder legal rights, and executive pay. Strong internal controls are vital to service risk management and significantly increase the probability that you'll achieve your goals. They likewise increase efficiency and enhance conformity while improving procedures and helping protect against fraud.

The Buzz on Pkf Advisory Llc

Constructing a thorough collection of interior controls involves strategy alignment, systematizing plans and procedures, procedure documentation, and establishing roles and responsibilities. Your internal controls should integrate risk advisory ideal techniques while constantly continuing to be concentrated on your core business goals. The most effective interior controls are strategically segregated to avoid possible disputes and lower the danger of monetary scams.

Creating good inner controls involves applying guidelines that are both preventative and investigator. They consist of: Restricting physical access to devices, stock, and cash Splitting up of duties Consent of billings Confirmation of expenses These backup treatments are developed to spot unfavorable end results and dangers missed out on by the first line of defense.

Internal audits include an extensive analysis of a service's inner controls, including its bookkeeping techniques and company monitoring. They're made to guarantee regulatory conformity, along with accurate and timely financial reporting.

Pkf Advisory Llc Fundamentals Explained

According to this legislation, management teams are lawfully accountable for the accuracy of their firm's economic declarations - pre-acquisition risk assessment. In addition to shielding financiers, SOX (and inner audit support) have actually substantially enhanced the reliability of public audit disclosures. These audits are done by objective third parties and are developed to examine a firm's accountancy treatments and internal controls

Report this page